Apply Digital Signature Certificate Online Within 30 Minutes

Get your DSC approved within 30 minutes of application. Fastest Application processing by our partners. Complete online paperless process along with PAN and Aadhaar based KYC.

DSC available for ROC Filing, Income Tax Filing, Tenders, Signing Documents, Banking, etc.

How to Apply digital signature certificate

Class III DSC for Signing & Encryption

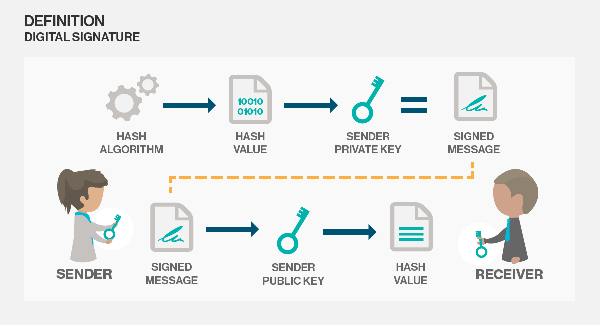

A digital signature is an electronic form of a signature that can be used to authenticate the identity of the sender of a message or the signer of a document, and also ensure that the original content of the message or document that has been sent is unchanged.

Digital signatures are easily transportable and cannot be imitated by someone else. The ability to ensure that the original signed message arrived means that the sender cannot easily disclaim it later.

What is the Difference between Digital Signature and Digital Signature Certificate?

Ans: A digital signature is an electronic method of signing an electronic document whereas a Digital Signature Certificate is a computer based record that:

- Identifies the Certifying Authority issuing it.

- Has the name and other details that can identify the subscriber.

- Contains the subscriber’s public key.

- Is digitally signed by the Certifying Authority issuing it.

- Is valid for either one year or two years

We at eTaxFinance will help you to procure digital signature from various authorised CA’s and deliver you across India.

Apply Online for Quick Approval Within 30 Minutes

Processing Methods of Digital Signature Certificate

We have three different paperless eKYC verification based methods for acquiring the Digital signature certificate. The applicant can opt for the method they prefer.

- Aadhar-Based Paperless DSC: Any applicant who is an Aadhaar card holder can apply for the Digital Signature Certificates in a paperless manner using, “Aadhaar Offline eKYC” procedure. Aadhar based KYC verification process is paperless and digital knows your customer (eKYC) procedure, wherein the application is carried forward after a digital verification of the applicant. The process of applying for a DSC application to generate orders and downloading the DSC is quick and can get completed within 15-20 mins.

- PAN Based Paperless DSC: By opting for the PAN-based Paperless DSC, the applicant can save on the relative cost. The process of obtaining the Pan-based Paperless DSC is easy, fast, and followed by a quick video verification, where the applicant needs to reflect their PAN card in the video. The best advantage of this Pan-based Paperless DSC generated after eYC verification is that one can apply for this type of DSC online anytime or anywhere, giving the applicant the gift of global convenience.

- GST Based Paperless DSC: We provide the GST Based paperless Organisational DSCs (Digital Signature Certificate) for Organisations having their exclusive GST certificate. These certificates provide complete security by ensuring confidentiality to the information or documents with Digital Signature when shared digitally.

Classes of Digital Signature Certificates

According to the new guidelines released by CCA, only Class 3 DSC can be issued. However, all the class 2 certificates purchased before will remain active and in use.

- Class 3 Digital Signature Certificate: We also offer class 3 digital signature certificates according to IVG guideline which is considered as the most secure and the safest of all certificates. It is mainly used in matters of high security and safety such as e-filing, online trading and e-commerce, where a huge amount of money or highly confidential information is involved. Following are the main functions of Class 3 certificates –

- e-Tendering

- Patent and Trademark

- e-filing MCA

- e-filing Income Tax

- e-filing LLP registration

- Customs e-filing

- e-Procurement

- e-Bidding

- e-Auction

- GST Application filing

Documents Required for Digital Signature Certificate

Required Documents depends upon the type of applicant and mode of verfication for KYC.

Option 1: Individual (PAN Based KYC):

- Passport Size Photograph

- Self Attested Copy of PAN Card

- Proof of Identity (Passport / Aadhar / Driving License / Voter ID)

- Applicant show Original PAN and Aadhaar Card in Video

- A Unique Email Id & Mobile Number is required for each director to make Digital Signature Certificate.

Option 2: Individual (Aadhaar Based KYC):

- Passport Size Photograph

- Self Attested Copy of PAN Card

- Proof of Identity – Aadhaar

- Offline Aadhaar XML downloaded from UIDAI website.

- A Unique Email Id & Mobile Number is required for each director to make Digital Signature Certificate.

Option 3: Organisation (With GST Certificate):

- Passport Size Photograph

- Self Attested Copy of PAN Card

- Proof of Identity (Passport / Aadhar / Driving License / Voter ID)

- Applicant show Original PAN card and GST Certificate in Video

- A Unique Email Id & Mobile Number is required for each director to make Digital Signature Certificate.

Option 4: Organisation (Without GST Certificate):

- Passport Size Photograph

- Self Attested Copy of PAN Card

- Proof of Identity (Passport / Aadhar / Driving License / Voter ID)

- Applicant show Original PAN card / 3 Months Bank Statements / ITR First Page Copy in Video.

- A Unique Email Id & Mobile Number is required for each director to make Digital Signature Certificate.

Simple and Transparent Pricing

“We Deliver what we promise!” is not a tag line that we invented, it is actually how clients describe us.

Basic

(Inclusive of All Fees & Taxes)

₹

1199

-

Class III - Signing

-

Individual Applicant

-

ePass 2003 Token

-

2 Years Validity

Popular

Standard

(Inclusive of All Fees & Taxes)

₹

1999

-

Class III - Signing & Encryption

-

Individual Applicant

-

ePass 2003 Token

-

2 Years Validity

Premium

(Inclusive of All Fees & Taxes)

₹

1999

-

Class III - Signing & Encryption

-

Organisation Applicant

-

ePass 2003 Token

-

2 Years Validity

- Digital Signature Certificates with 2 Years validity shall be provided in a single ePass 2003 Token.

- Price may differ depending upon the choice of CCA by the Applicant.

- Free Delivery of Token across India through Indian Government Postal System. In case of change in delivery partner, additional delivery charges will be levied.

Frequently Asked Questions

FAQ Resolution to Common Queries for your doubts related to Digital Signature Certificate

Digital Signature Certificates (DSC) are the digital equivalent (that is electronic format) of physical or paper certificates. Few Examples of physical certificates are drivers’ licenses, passports or membership cards. Certificates serve as proof of identity of an individual for a certain purpose; for example, a driver’s license identifies someone who can legally drive in a particular country. Likewise, a digital certificate can be presented electronically to prove one’s identity, to access information or services on the Internet or to sign certain documents digitally.

Physical documents are signed manually, similarly, electronic documents, for example e-forms are required to be signed digitally using a Digital Signature Certificate.

A licensed Certifying Authority (CA) issues the digital signature. Certifying Authority (CA) means a person who has been granted a license to issue a digital signature certificate under Section 24 of the Indian IT-Act 2000.

The Certifying Authorities are authorized to issue a Digital Signature Certificate with a validity of one, two or three years.

Please follow the below instructions to limit the increase in PDF file size while affixing the Digital Signature Certificate (DSC).

1. Open any PDF file or right click any PDF file.

2. Select Edit > Preferences. The Preferences window is displayed.

3. Select Category: Signature. The Digital Signatures section is displayed.

4. Click “More” button under the Creation & Appearance section.

5. Uncheck “Include signature’s revocation status” option.

Note – The above change in preference settings is specific to each client desktop.

Digital Signatures are legally admissible in a Court of Law, as provided under the provisions of IT Act, 2000.

- Digital Signature Certificate (DSC) Applicants can directly approach Certifying Authorities (CAs) with original supporting documents, and self-attested copies will be sufficient in this case

- DSCs can also be obtained, wherever offered by CA, using Aadhar eKYC based authentication, and supporting documents are not required in this case

- A letter/certificate issued by a Bank containing the DSC applicant’s information as retained in the Bank database can be accepted. Such letter/certificate should be certified by the Bank Manager .